Breaking Down Investing: If not now, When?

Diving into the investment journey can stir up a mix of excitement and apprehension—we’ve all been there. It’s perfectly normal to feel a twinge of worry and even get a case of cold feet, especially when unsettling rumors or news start circulating. Hey, we’re all human, and that urge to hit the sell button when things get a bit nerve-wracking is like a reflex. But here’s the scoop from this friendly sage: amidst the noise, there’s no better time than the present to navigate those worries and consider the untapped potential that lies in the market right now.

Is the Bubble about to burst?

We often hear about bursting bubbles—housing, AI, corporate real estate. True bubbles, like the Dutch Tulip Mania, are rare. Despite periodic setbacks, our contemporary stock market has proven resilient. Take the crashes of 1929 and 1987 as examples—stomach-churning drops followed by impressive recoveries. Savvy investors recognized opportunities during downturns, understanding that a drop in prices doesn’t mean a perpetually bursting bubble.

Nobody is that good.

Now the knee jerk reaction is simple. Sell in 1999 and buy in 2002. Sell in 2007 and buy in 2009. For those of you readers who have a crystal ball, it’s as simple as that. In the real-world people are much more likely to sell well before the top and gain no advantage when the prices fall. The lesson? Market timing perfection is elusive, so the best time to invest is now and the best time to safeguard your investments is now.

Over an extended period, the market tends to ascend, offering substantial returns. Yet, it’s no secret that this ascent is marked by intermittent bouts of unexpected turbulence. The smart move? Stay in the game but arm yourself with a cost-effective hedge. Be prepared for the inevitable pullbacks by incorporating a well-thought-out strategy that capitalizes on market dips. A proactive approach ensures not just survival but the opportunity to thrive amidst the waves of volatility. It’s not just about being invested; it’s about being strategically positioned for the long game, ready to seize opportunities that others might overlook.

It’s easy to get caught up in the drama of fear-inducing headlines. Our brains are wired to pay attention to alarming news, triggering a sense of urgency. But let’s steer away from the panic and talk about why your golden opportunity in investing might be now.

Cycles are normal.

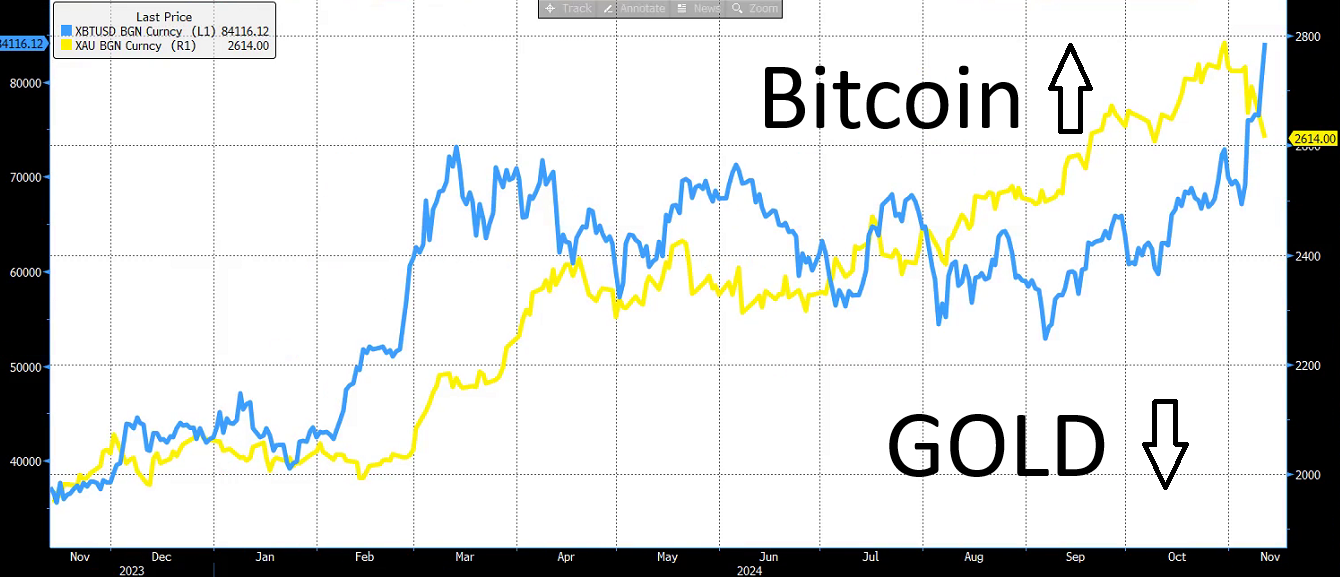

Another aspect often overlooked is the existence of a cycle. Think of it as a tech evolution cycle. Right now, Artificial Intelligence (AI) is in the spotlight. As people rush to invest in AI-related companies, stock prices soar. Over time, expectations may fall short, causing a dip in prices—an attractive opportunity for investors seeking substantial returns. It’s a constant ebb and flow in the world of investing.

Volatility is normal.

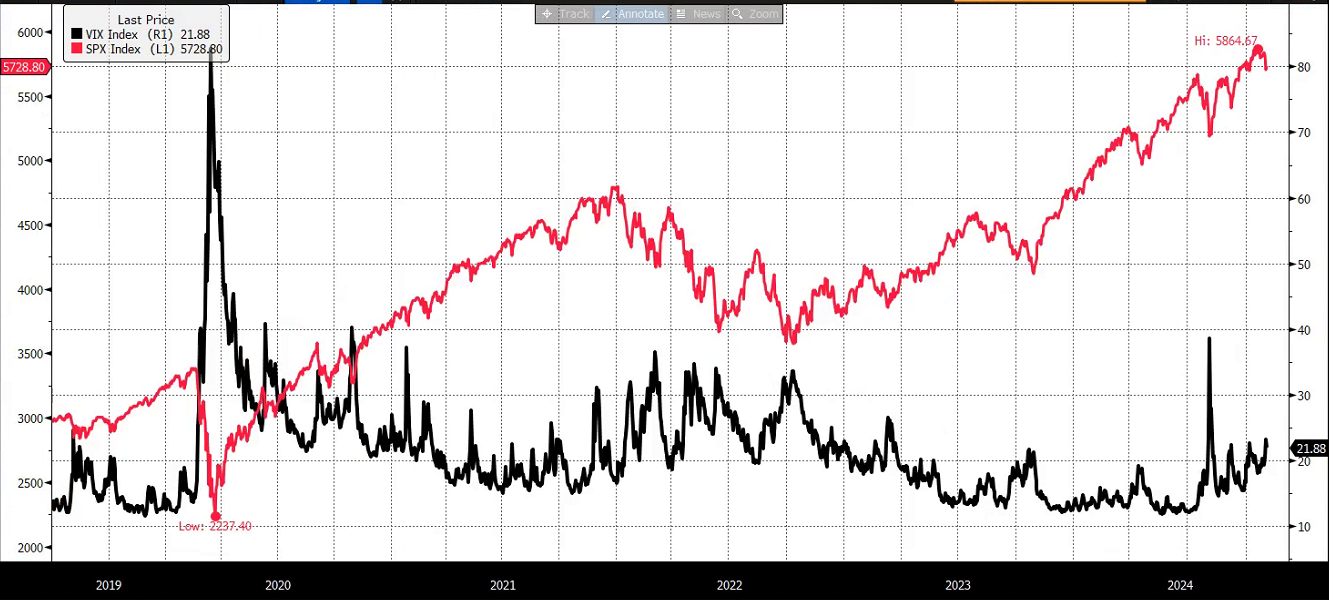

Pay attention to this key idea: while the stock market generally goes up in the long run, the ups and downs, or volatility, are like a rollercoaster ride. When stocks dive, volatility skyrockets; when they soar, volatility takes a breather. Volatility is the wild twist and turns in the market journey. It’s intense, but the market tends to keep on growing, while volatility never goes away.

In my career, I’ve experienced various bouts of market volatility—the 2008 Great Recession, the European debt crisis, and even the grand finale with COVID. Despite the chaos, the market kept marching higher. Embrace volatility as the spice that keeps the market flavorful. It’s not the monster under the bed—it’s an opportunity waiting to be seized. The secret sauce? Stay invested for the long haul, anticipate volatility, and use those peaks as golden moments to make strategic moves in your portfolio. See every challenge as an opportunity, especially when others are feeling the fear. Embrace uncertainty—it’s where the real opportunities lie!

Joe Tigay

Joe Tigay