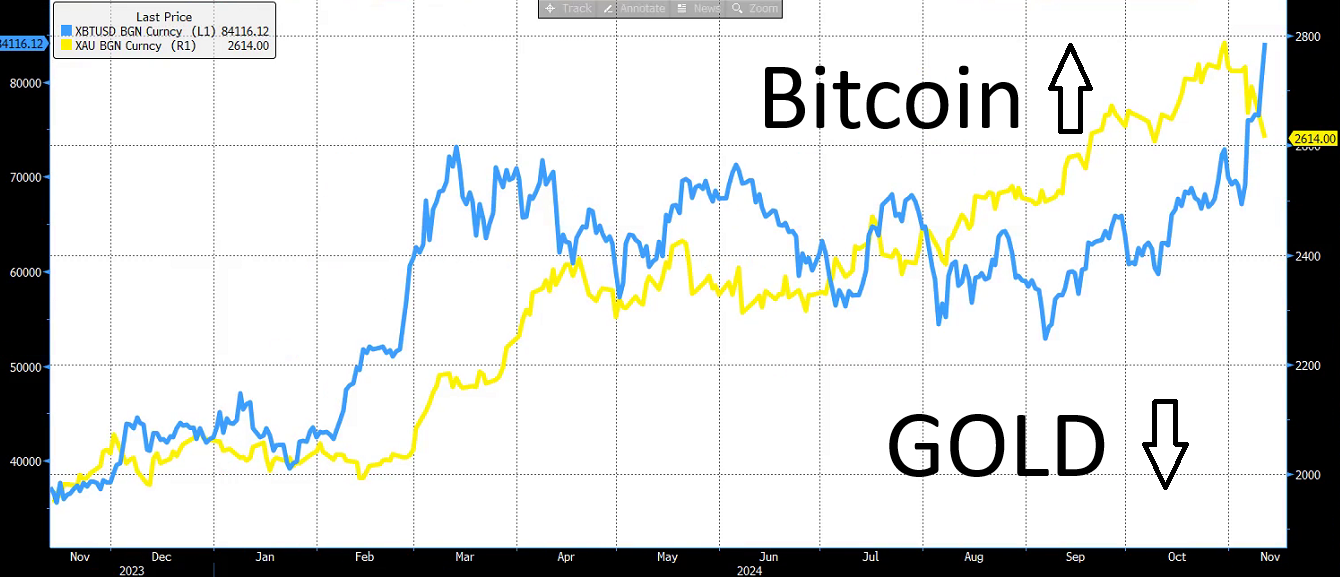

The stock market in 2023 has been a wild ride.

Don’t miss the forest for the trees. The market narrative in January suggested that technicals were strong, and the economy was in a moderate state, which allowed for rates to fall. However, better-than-expected job numbers and retail sales showed that the market’s technical strength was due to a stronger fundamental base. Consequently, the market has revised its prediction for the FED’s terminal rate by one or two rate hikes. As of February, the market has strong fundamentals but weak technicals due to the massive annual jobs and retail sales figures.

Watching the market its critical not to get so obsessed with small details and keep a wider view of what’s going on. The current situation takes us back to the 2022 trade, which focused on modifying expectations about the height of rates. The market narrative may be misleading, but it is just part of the economic cycle, consisting of alternating periods of expansion and contraction, with the FOMC having a key role in influencing but not being the only one. Focusing too much on daily price movements without considering the overall market trend can lead to missed opportunities and failure to recognize potential risks. It’s essential to take a step back and see the bigger picture to make informed investing decisions.

This economic cycle has been significantly impacted by COVID-19 and the unprecedented stimulus measures implemented. In all economic cycles, when the Fed raises rates, it’s because the economy is so strong that excess inflation is likely to occur. Conversely, when the Fed stops raising rates, the economy is no longer expected to cause inflation to rise higher than normal.

To get a better understanding of where we are and what we can expect next, let’s take a quick look at the stages of the economic cycle.

Expansion:

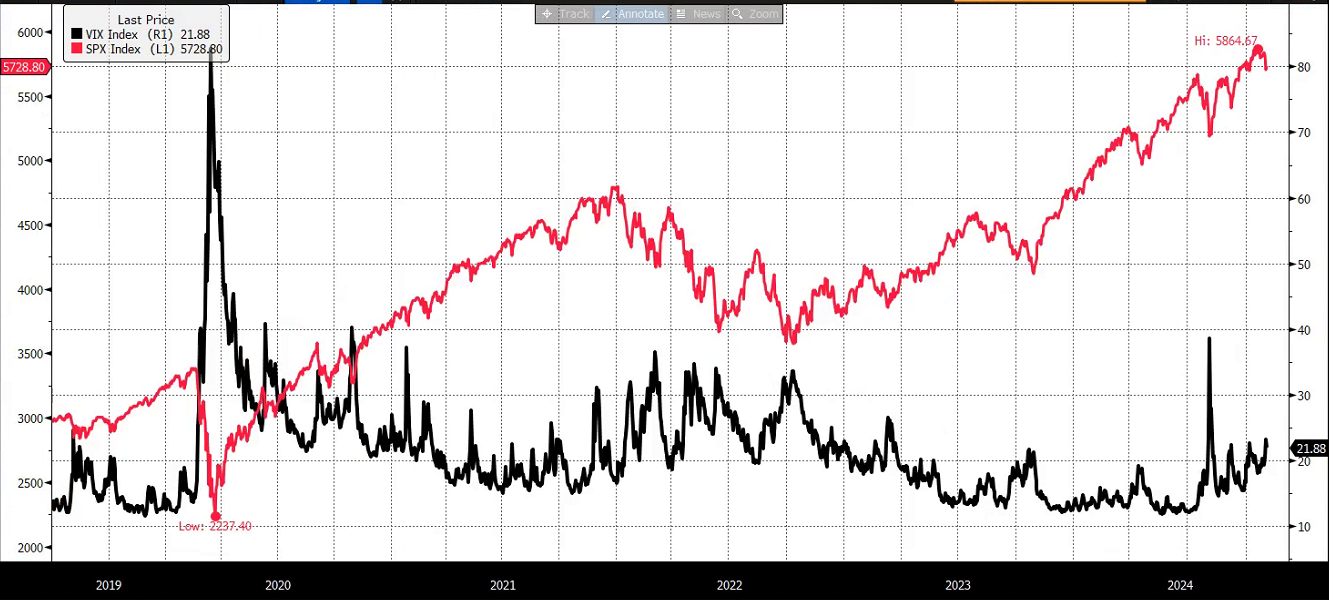

During the expansionary phase of the economic cycle, there is an uptick in economic output and employment levels, with increased consumer confidence and business expansion. To avoid excessive inflation, the FOMC increases interest rates and may sell government securities in the open market to reduce the money supply and slow economic growth. Simultaneously, the stock market thrives as corporate profits increase, investor sentiment is high, and stock prices rise, resulting in a surge in risk-taking behavior. Consequently, low volatility characterizes the stock market during strong economic growth periods.

Peak: We are here

The peak phase signifies the end of the expansionary phase and the start of a contractionary phase, with economic activity at its highest but growth slowing down as the economy approaches full capacity. The FOMC historically continues to raise interest rates to prevent overheating and control inflation, but due to Covid, the cycle was delayed, leading to unprecedented inflation. In the early stages of the peak phase, the stock market may still perform well, but as concerns about inflation and interest rates increase, stock prices may decline, and investors may shift to safer assets like bonds. As the economy slows and inflation and interest rate concerns rise, investors may become more risk-averse, leading to increased volatility and a shift to safer assets.

Contraction:

In the contractionary phase of the economic cycle, economic output and employment levels decline, and businesses reduce production due to low consumer confidence. To counteract this, the FOMC may lower interest rates to stimulate borrowing and spending and use open market operations, such as Quantitative Easing, to increase liquidity in the financial system.

However, during this phase, the stock market tends to perform poorly as corporate profits decline, and investors become more risk-averse, shifting their investments towards safer assets. The uncertainty about the economy’s direction and declining investor confidence can lead to high volatility, with investors selling off assets at the first sign of trouble.

Trough:

The trough phase marks the transition from the contractionary phase to the beginning of a new expansionary phase. Economic activity is typically at its lowest during this phase, but the economy is showing signs of recovery. To support the recovery, the FOMC may keep interest rates low to encourage borrowing and investment.

During the early stages of the trough phase, the stock market may still perform poorly as economic conditions remain weak. However, as the economy starts to recover, investor sentiment may improve, leading to an increase in stock prices and the start of a new expansionary phase. Investors who are anticipating an upcoming expansion will keep an eye out for a volatility top and a stock market bottom during this phase.

Conclusion

Understanding the economic cycle and the role of the Federal Reserve is crucial for investors who want to navigate the stock market successfully. But remember, even the most astute investors can’t predict the future with 100% accuracy. As the famous economist John Kenneth Galbraith once said, “The only function of economic forecasting is to make astrology look respectable.” So, keep your eyes on the economic indicators, stay informed, and don’t forget to cross your fingers for good luck!

Joe Tigay

Joe Tigay